April is Financial Literacy Month, and some educators have taken to Twitter with their goals and plans, using the hasgtags #FinLit and #FinLitMonth. Educator Lisa S. Bender has tweeted her lesson plans for each day, including tips like using index cards.

A number of free online program and curriculum resources exist. TeacherCents.com offered an 18-point list of resources, and websites like practicalmoneyskills.com and www.tomorrowsmoney.org offer downloadable materials for schools.

Other attempts have been more creative and innovative. PwC and the MIND Research Institute used a multi-million dollar grant from PwC Charitable Foundation to create game software to teach students how to handle their money. Another initiative was a partnership with the magazine "Time for Kids" in order to launch a new money management magazine, "Your $," aimed at fifth and sixth graders. The four-page mini-mag covered budgeting, investing and taxes.

Teachers College at Columbia University’s Joyce Cowin Financial Literacy Program also aims to help. Aimed specifically at 11th and 12th graders, their Loot Inc. financial literacy initiative is designed to bring experiential learning to disadvantaged urban schools. The Loot Inc. website offers resources for teaching financial literacy and a virtual community of teachers. The school also offers an annual program, the Cowin Financial Literacy Institute, every July to train teachers. Held in NYC, the training is free and even gives attendees a $200 stipend.

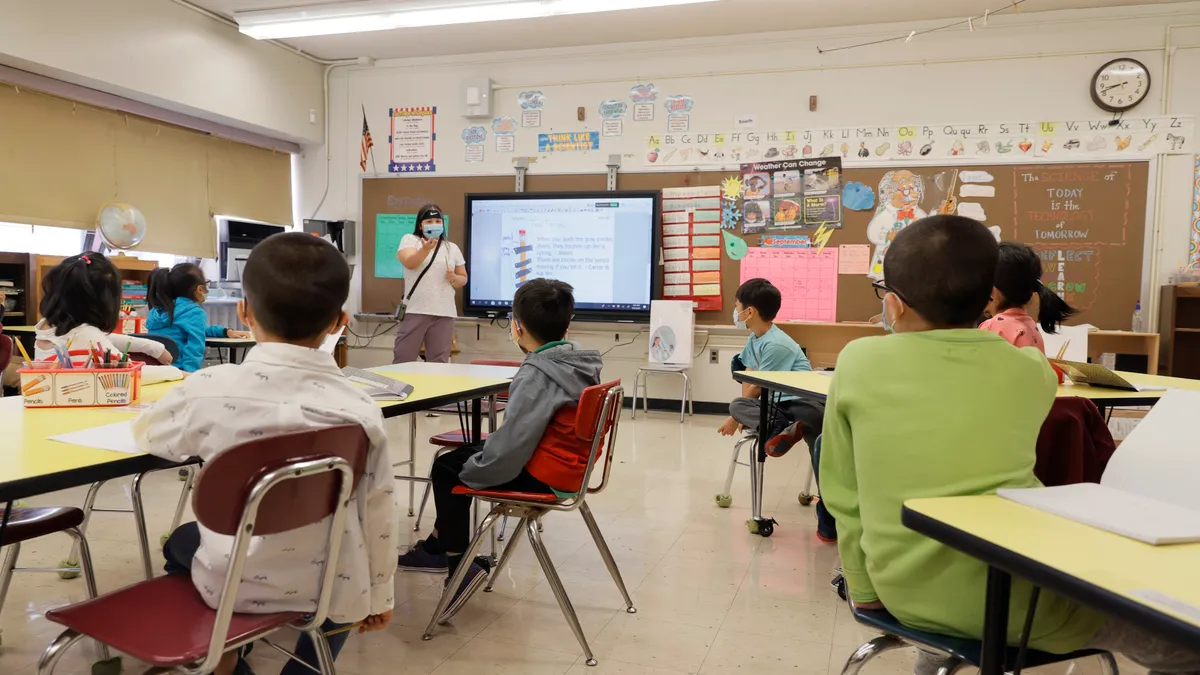

In Arizona, all K-12 schools are required to teach financial literacy skills. The execution of the mandate is flexible, and officials at each school are able to design their own curriculum, with many choosing to blend the topic into other subject areas. Missouri, Tennessee and Utah also all require students to take one semester of financial literacy in high school.

In Oklahoma’s largest district, Oklahoma City Public Schools, financial literacy lessons are wrapped into a government course required for seniors. And in Maryland, some educators use a goal curriculum called “SMART,” which stands for "specific, measurable, attainable, relevant and time-bound." There, students practice with attractive real-world examples, practicing money-saving exercises to achieve goals like buying imaginary cars.

Chicago Public Schools (CPS) have also been a leader. In May 2012, the district announced plans to integrate rigorous financial literacy framework into K-12 curriculum. “The Financial Literacy Initiative will launch this fall, along with a personal finance course for 12th grade students in the spring and training for 250 teachers that is being funded by a $1 million grant from Discover Financial Services,” the district noted online.

So far, the initiative seems to be paying off. It’s also expanded: around 100 elementary schools in the district now also participate in “Talk With Our Kids About Money Day,” a program created by the Canadian Foundation for Economic Education and BMO Financial Group.

Teaching financial literacy isn’t easy, but it’s important. Without understanding the basics of money management, youth often end up in hard situations involving credit, debt and economic instability. American students in college are often so unprepared that some institutions have adopted holistic programs aimed at increasing their financial responsibility and wellness.

Yet some experts say instruction in college is too late and teaching financial literacy needs to start earlier to prevent problems before they arise. Research from the Program for International Student Assessment (PISA) exam previously showed more than one-sixth of American 15-year-olds didn't meet basic proficiency benchmarks in the financial literacy.

For those K-12 teachers seeking to incorporate financial literacy teaching in their schools, various challenges exist. A recent report "Bridging the Financial Literacy Gap: Empowering teachers to support the next generation" by PwC laid out a few primary barriers, including a lack of appropriate curriculum structure and take-home materials to teach financial literacy, as well as teacher proficiency in and comfort with teaching the subject. There are also cultural hurdles, since financial education isn’t widely seen as a critical skill for college and career readiness.

Many teachers agreed financial literacy teaching should start as early as elementary school, the report found. But at the same time, the majority of educators said they weren’t comfortable teaching it. Just 31% feel “completely comfortable,” 51% feel “moderately comfortable” and 18% feel “not comfortable at all.” Only 12% of all K-12 teachers said they incorporated financial planning into their lessons.

The Council for Economic Education (CEE) conducts a biennial comprehensive study that examines the state of K-12 economic education. For the 2016 Survey of the States, personal finance education growth was shown to be sluggish.

“While more states are implementing standards in personal finance, the number of states that require high school students to take a course in personal finance remains unchanged since 2014 – just 17 states,” the report noted. A total of 20 states required high school students to take a course in economics, which is two fewer than in 2014. And for improvement, that number will likely have to increase.

Dive Awards

Dive Awards