WASHINGTON — Opposition and support to an historic federal proposal to provide a private school choice tax incentive nationwide is ramping up as Republicans in Congress strive to meet an ambitious timeline for the legislation.

The Educational Choice for Children Act, a Republican-backed bill that was included in a massive tax and spending package also known as the “One Big, Beautiful Bill,” was narrowly approved by the House in May. And although Senate Republicans have yet to release their version of ECCA, House Speaker Mike Johnson, R-La., said he wants to have the legislation to President Donald Trump by July 4.

Lawmakers are using a reconciliation process to pass the bill through Congress, which allows the Senate to approve spending measures with a simple majority rather than the 60 votes needed to overcome a filibuster.

Under the House plan, taxpayers could make charitable contributions toward tuition or other expenses at public, private and religious K-12 schools and receive a dollar-for-dollar tax break for their contributions. The donations would be managed by a scholarship-granting organization that would distribute them to participating families to use for education expenses.

The total credits are capped at $5 billion per year from 2026 through 2029. It would be the first federally funded private school tax credit program available across the country and has the potential to drastically change public school systems.

Although ECCA is just a tiny portion of the overall tax package that aims to make permanent tax cuts enacted in 2017 under the first Trump administration, critics and supporters have increasingly been making their viewpoints on the school choice proposal known over the past month.

Lawmakers on both sides of the aisle have held separate press conferences on the issue and advocates on both perspectives of the debate have been lobbying lawmakers, while GOP and Democratic-leaning organizations are publishing essays about the program's pros and cons.

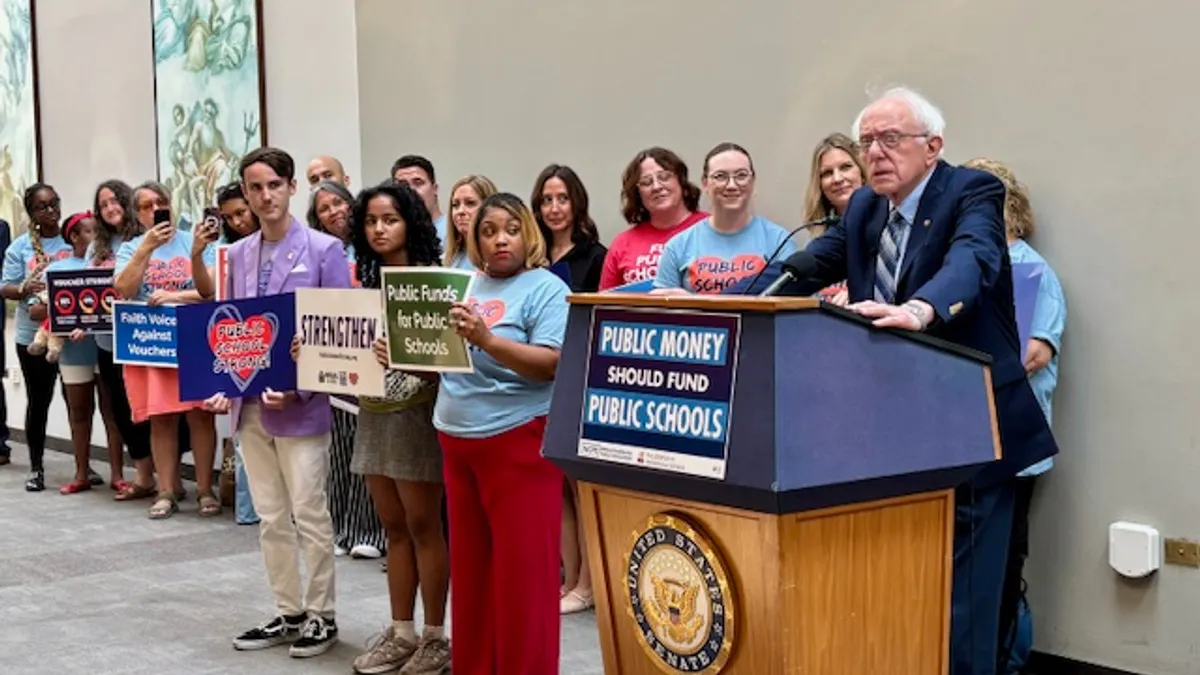

On Thursday, Democratic lawmakers and public school supporters held a press conference on Capitol Hill in Washington, D.C. A few hours later, Republican leaders and school choice advocates held their own event nearby. And in between, a rally was held outside the U.S. Capitol where speakers denounced the tax bill as harmful to children.

"One thing we should certainly not be doing is creating a two-tier education system in America — private schools for the wealthy and well-connected, and severely underfunded public schools for low-income, disabled and working class kids," said Sen. Bernie Sanders, I-Vt., at a Thursday press conference held by public school advocates. "That is not what this country is supposed to be about."

Speaking at the same event, Paul Schulte, who has taught in Nebraska schools for 26 years and is vice president of the Nebraska State Education Association, asked, "How are we going to continue to support our schools in serving students with disabilities, like the ones at Disney Elementary where I taught, when they are transferring $5 billion a year to support families in private schools and home schools?"

Other speakers at the event raised concerns about taxpayer funds subsidizing private school tuition and denounced fewer resources being available for public schools when state-level private school choice programs were implemented.

But at the pro-ECCA event, speakers said the proposed school choice tax incentive would allow students to leave "failing" schools and choose higher-performing schools that best fit their needs.

"When parents are empowered to make decisions and are empowered with the resources to make those decisions, their children thrive," said Rep. Byron Donalds, R-Fla. "For the first time in American history, we will be telling parents all across America — whether they're in a red state or whether they're in a blue state — that the choice is theirs and that the economic power is theirs."

Sen. Ted Cruz, R-Texas, said at the event that the Senate ECCA proposal is still being drafted, but its structure will be similar to the House version.

Cruz also said arguments against ECCA as being detrimental to public school systems are false. He highlighted public school systems in Florida and Ohio that he said improved when those states implemented private school choice programs, because the competition for students drove progress.

According to EdChoice, a nonprofit that supports school choice, 35 states and the District of Columbia have some type of private school choice program. Collectively, they serve nearly 1.3 million students.

Having a high-quality education leads to the "American dream," Cruz said. "So the attacks against this are all motivated by protecting money for adults at the expense of the kids."