While a public company's earnings reports are typically a good source of information for investors, those same SEC filings can also serve to provide key insight on a variety of trends shaping an industry.

Though there aren't a plethora of publicly traded companies operating primarily in the education space, the few that do still speak volumes on the changing face of education—and on several fronts. A quick look at a handful of recent earnings releases from for-profit colleges and textbook publishers reveals three key trends likely to have a considerable impact on the education space in both the short- and long-runs.

1. FOR-PROFITS ARE LOSING STUDENTS

Companies impacted: DeVry Inc., Career Education Corporation, Apollo Group Inc. and other for-profit institutions

Declining enrollments are costing for-profit education companies big money. In its August second-quarter earnings release, Career Education Corporation reported tuition and registration fees revenue of $289.2 million, down $70.6 million from the same quarter last year. Apollo Group Inc. had a 17% decline in enrollment during the third quarter, which ended in May, reporting overall revenues of $946.8 million—$175.5 million less than the same quarter last year. Strayer Education Inc. also saw continuing student enrollments fall 12% and new student enrollments fall 17%, causing a $14.3 million revenue decline over the previous year for the quarter ending in June.

In Apollo Group's third quarter earnings call, CEO, Director and Chairman Gregory W. Cappelli projected future enrollment growth as the company rebrands itself, partially attributing the decline to recent campus closures—the company closed more than 100 campuses for its primarily online for-profit University of Phoenix in December—and noting that he wouldn't get into "the exact quantification of it." DeVry noted its own realignment in its fourth quarter release.

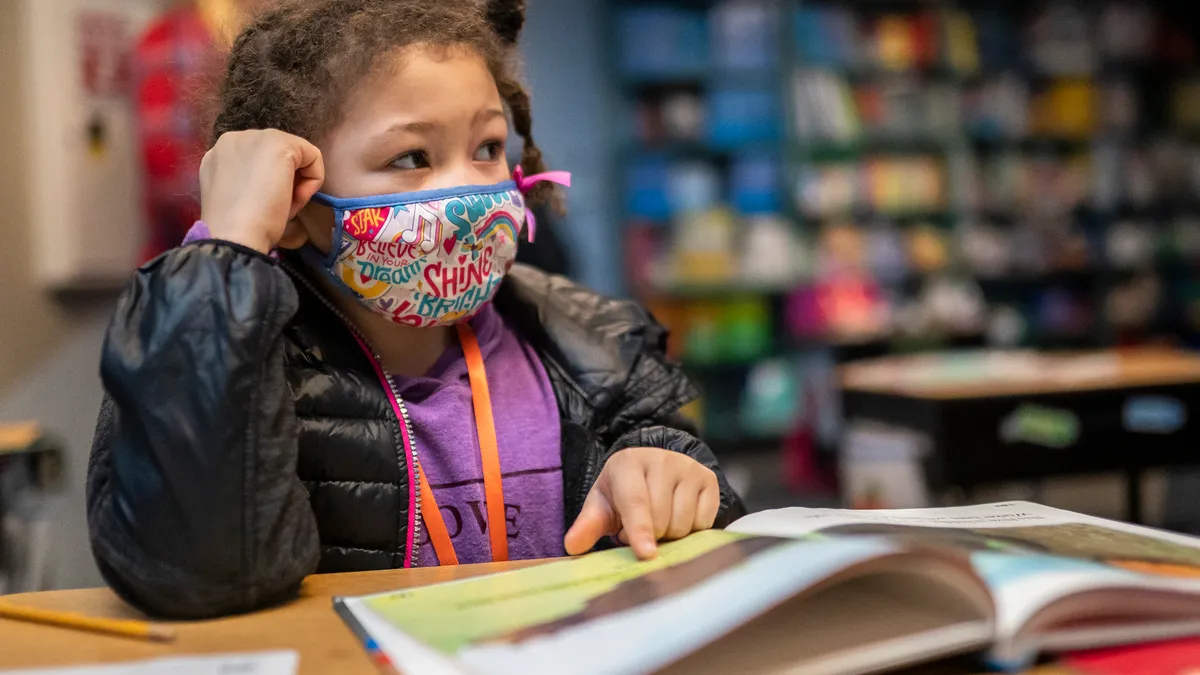

It's no secret that the sector has been plagued by issues ranging from over-priced tuition (price adjustments are also mentioned in the earnings calls) to predatory recruitment, both of which are probably contributors to the high dropout rates. Those issues have also contributed to some unwanted attention in the last several years.

2. PENDING REGULATIONS COULD CREATE MORE LOSSES

Companies impacted: Apollo Group Inc., Strayer Education Inc., Career Education Corporation and other for-profit institutions

U.S. Senator Tom Harkin has had the for-profit education industry in his crosshairs for several years now. The Iowa Democrat is chairman of the U.S. Senate Committee on Health, Education, Labor and Pensions, and in 2012, he wrapped up a two-year investigation questioning whether the industry's high dropout rate merited continued federal aid and loan investment. Along with the aforementioned high dropout rates, predatory recruitment and high tuition, Harkin also found that for-profits spend a disproportionate amount of money on marketing.

The high number of military students enrolled in for-profits probably doesn't help diminish federal attention, either. In Career Education's most recent earnings call, CEO and President Scott Steffey noted the increasing popularity of his company's Colorado Technical University among active military members, saying, "According to a survey of Defense Department Information by Military Times Edge magazine, CTU is the 25th most popular university the nation in terms of where military students are choosing to use their tuition assistance benefits."

Strayer Education Inc., Apollo Group and Career Education Corporation all make direct references to the potential for increased regulation on the industry in their releases, as well. All three make note of the enrollment and financial impacts potential regulations affecting their eligibility for Title IV funding could have. That's not to mention the impact the attention could have on accreditation, though Apollo and Bridgepoint haven't seemed to have too much trouble on that front despite prior warnings.

It's not a stretch to think that the federal attention alone could have further adverse effects on enrollment. After all, a degree from a school that has lost its accreditation or been shut down by the government is of questionable value at best.

3. TEXTBOOK PUBLISHERS EMBRACE DIGITAL AS PRINT SALES DWINDLE

Companies impacted: John Wiley & Sons Inc., Pearson PLC, other publishers

A changing campus environment is forcing the textbook market to innovate as print sales fall. The decline is attributable to the reported 82% increase in course material prices over the past decade, which has led to pushback from students and some faculty. As many as 34% of students even reported pirating their textbooks in a recent Book Industry Study Group survey, and the third annual CourseSmart survey earlier this year revealed that only 7% of students think print textbooks will remain dominant.

The numbers reported by major education publishers support these stats. In June, John Wiley & Sons Inc. reported fourth quarter revenues of $446 million, down $9 million from the same quarter the previous year. For fiscal 2013, the publisher was down $22 million to $1.76 billion. In the company's earnings call, Wiley CEO, President and Director Stephen M. Smith stated, "Print book revenues continue to be under pressure across all 3 segments as a result of tight library budgets, changes in student purchasing behavior, shrinking sales in brick-and-mortar sales channels and the continuing migration to digital."

In its own second quarter earnings call in July, Pearson PLC reported level K-12 business subdued by Common Core adjustments and uncertainty, though it reported its higher ed business had "grown modestly."

Both publishers have made moves in recent years to expand into digital services, with Pearson acquiring startups like virtual education program Embanet Compass. CFO and Executive Director Robin Freestone said Embanet Compass "is giving us a lot more capacity and capability, as well as taking us into the very important postgraduate market," while also touting eCollege, another virtual education program. Meanwhile, Wiley acquired higher ed online program provider Deltak for $220 million in October and e-learning systems provider ELS in November for $24 million.

Wiley, Pearson, Macmillan, Random House, McGraw-Hill, Cengage—which filed for Chapter 11 bankruptcy protection in July—and other publishers also offer lower-priced e-textbooks through a number of services, including the one recently announced for Google Play. However, Wiley's Smith reported that despite the growth in digital and its partial offset of declining print sales, the growth still isn't matching the pace of print's decline. Still nobody is debating that further innovation is the wrong direction—in fact, Pearson Education North America Executive Director and CEO William T. Etheridge says innovative services and products like the company's Common Core materials and MyLabs for higher ed are a necessity.

"The move to digital is going to happen. And while the timing may be a little bit unclear, it's going to happen. And people have been holding back for so long — they can only hold back for so long and they got to move to these new curriculum."

Would you like to see more education news like this in your inbox on a daily basis? Subscribe to our Education Dive email newsletter! You may also want to read Education Dive's look at Obama's new higher ed proposal: 4 pros and 4 cons.